Buffett's Bet on Occidental Petroleum

Berkshire's stake could soon surpass a key level with important implications. Could this be a prelude to Buffett making an offer to acquire the company?

“Now it’s quite apparent, I think, that we want — we’re very happy — we should be very happy — that we can produce 11 million barrels a day, or something of the sort, in the United States, rather than being able to produce none and having to find 11 million barrels a day somewhere else in the world to take care of keeping the American industrial machine working.”

— Warren Buffett, April 30, 2022

The World Still Needs Petroleum

The geopolitical events of 2022 have shattered the notion that the world economy can function without fossil fuels. It is more clear than ever before that petroleum products will remain a necessity for a long time to come. Having reliable access to such energy sources is crucial for economic security. Placing a country’s energy security in the hands of potentially hostile foreign powers can have severe consequences.

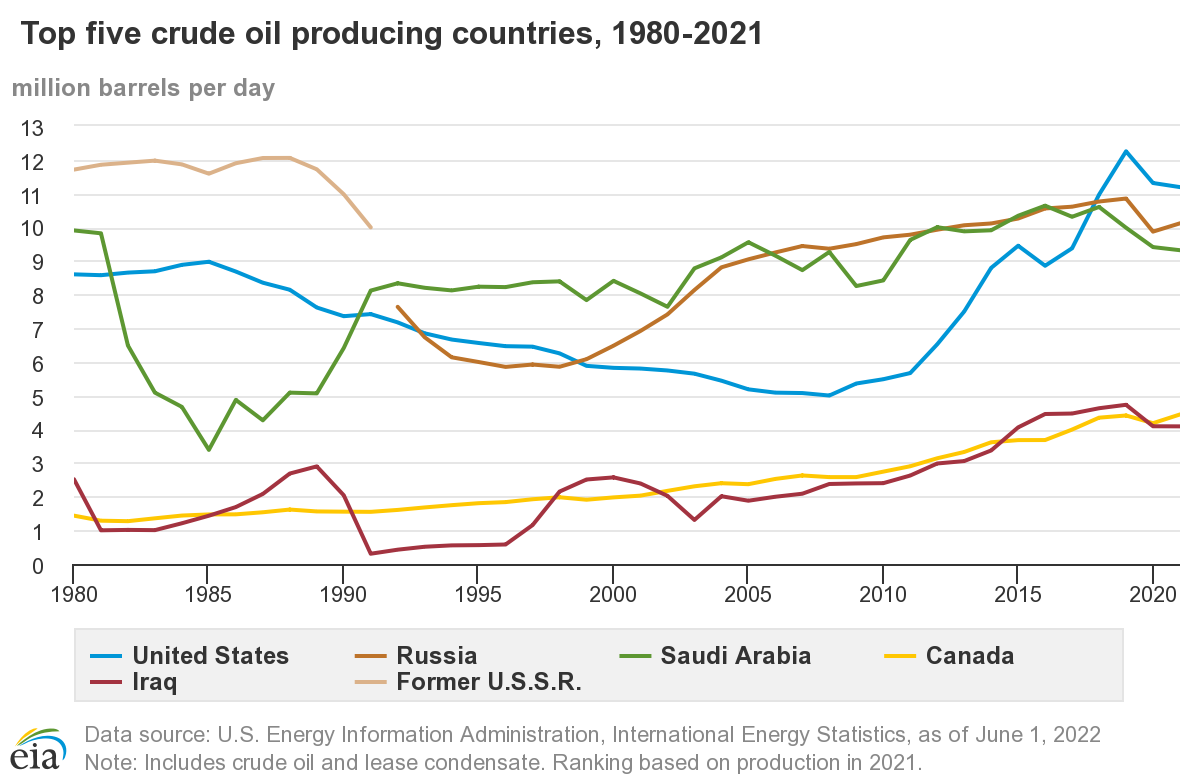

As Warren Buffett points out, it is very good news that the United States has the capacity to produce a majority of the ~20 million barrels per day of petroleum that the country consumes. In fact, the United States was the top crude oil producer in 2021 at 14.5% of worldwide production, ahead of Russia, Saudi Arabia, Canada, and Iraq.

There has been a great deal of political pressure in the United States to reduce the country’s reliance on fossil fuels in favor of renewable energy. However, this is a multi-decade process regardless of the shifting political winds. As the world transitions to renewable energy, having the optionality provided by petroleum resources in the ground is unquestionably a major asset for the United States compared to countries, such as the member states of the European Union, that are more reliant on imports.

Warren Buffett has often said that making investments based on macroeconomic or geopolitical factors is very difficult and should be avoided. However, it is difficult to view his recent investments as unrelated to the geopolitical events of 2022. Russia invaded Ukraine on February 24 and Berkshire’s purchases of Occidental Petroleum common stock began on February 28. This doesn’t seem like a coincidence.

This article summarizes Berkshire’s recent investments in the common stock of Occidental Petroleum based on the company’s SEC filings. In addition, it is interesting to consider the implications of Berkshire exceeding 20% ownership of Occidental since there are some accounting and tax effects above that threshold. There has also been speculation that Berkshire could make an offer to acquire Occidental and it is worth considering how likely this is to occur.

Buffett’s Bet on Oil

Warren Buffett has been putting Berkshire’s money behind his conviction in the future prospects of oil. Although the media has focused more on Berkshire’s growing investment in Occidental Petroleum, Berkshire actually has a larger position in Chevron with 159,178,117 shares held as of March 31, 2022 which are worth ~$22.9 billion as of July 21, 2022. Since Berkshire has not breached the 10% ownership level for Chevron, the company is not required to file SEC disclosures for new purchases. It is possible that Berkshire’s stake in Chevron has grown since March 31.

In contrast, Berkshire’s investments in Occidental exceeded the 10% threshold in March triggering a series of SEC disclosures. This was followed by Mr. Buffett’s statements regarding the purchase at the 2022 Berkshire Hathaway annual meeting which took place on April 30. Since that time, Berkshire has continued to add to its Occidental position and now owns approximately 19.4% of the company.

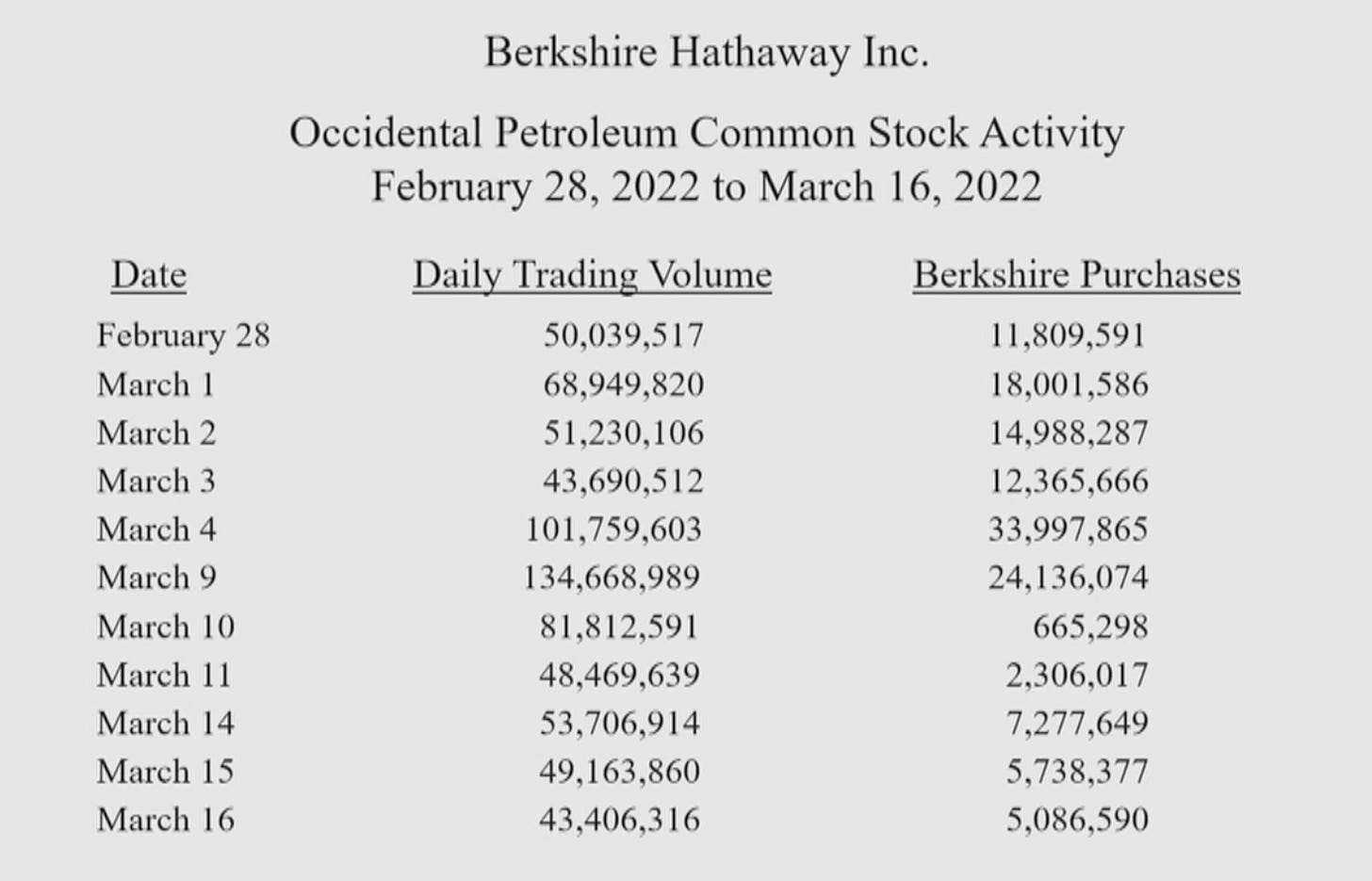

At the annual meeting, Mr. Buffett made extended comments regarding his purchase of more than 14% of Occidental over a period of just two weeks. He presented a slide showing his purchases of Occidental and I have excerpted part of his comments:

“That shows how we bought what became — well, we bought in two weeks, or thereabouts, 14% of Occidental Petroleum. And you’ll say, “Well, how can you buy 14% of a company in two weeks?” And it’s more extreme than that, because if you look at the Occidental proxy, you’ll see that — the standard names — BlackRock index funds, State Street index funds, basically, Vanguard index funds, and then one other firm, Dodge & Cox.

If you take those four entities — and they’re not going to buy and sell stock — they may get their own little — so they own 40% of the company, roughly, those four firms. And they didn’t do anything during this period. So now you’re down to 60% of the Occidental Petroleum Company that’s even available for sale.

Occidental’s been around for years, and years, and years. Big company, all kinds of things. And with 60% of the stock outstanding, I go in and tell Mark Millard, this fellow that is 30 feet away from me or so, and I say in the morning to him, you know, “Buy 20% and take blocks, or whatever it may be.” And in two weeks, he buys 14% out of 60%.”

Mr. Buffett was making a broader point about how speculative market participants have become in recent years. To be able to accumulate so many shares of Occidental in a short period of time demonstrates that the prior owners were likely short-term speculators rather than long-term investors.

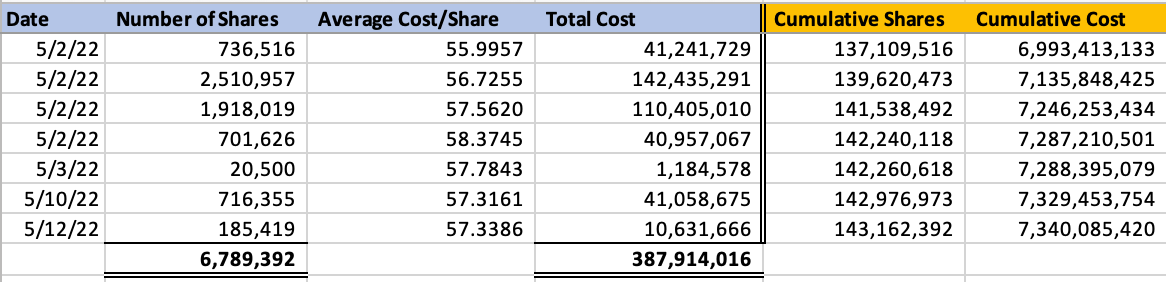

At the time of the annual meeting, Berkshire owned 136,373,000 shares of Occidental, all purchased between February 28 and March 16. It is interesting to look to the source data filed with the SEC during that period as well as additional purchases made in May, June, and July which are summarized below.

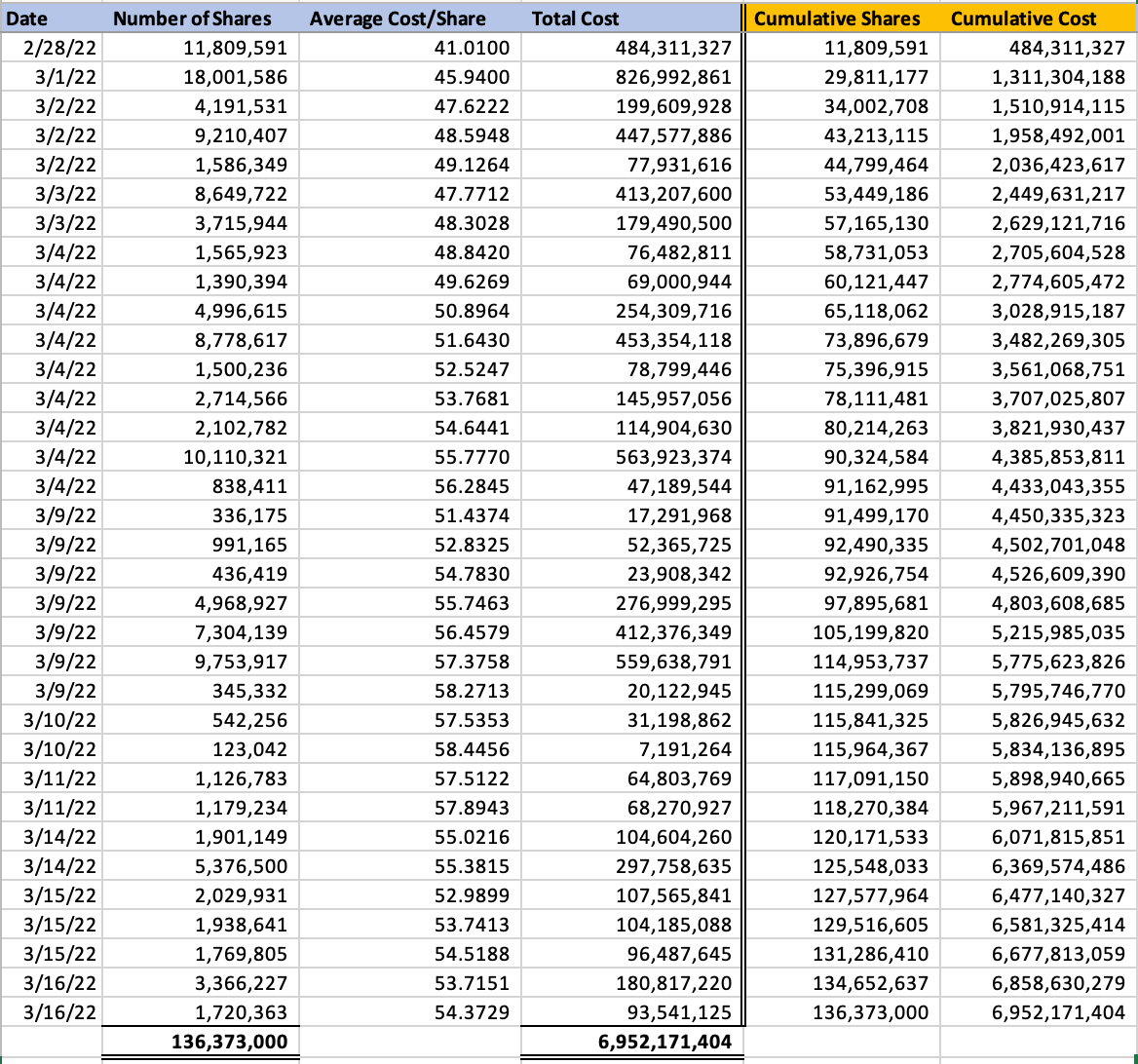

The following exhibit shows all of the purchases Berkshire reported to the SEC from February 28 to March 16. These are the purchases Mr. Buffett discussed at the annual meeting on April 30. The blue columns show the individual purchases and the orange columns are a running total of the number of shares and cost after each purchase:

During this period, Berkshire paid just under $7 billion to purchase 14.6% of the company at an average price per share of $50.98.

On May 2, the Monday following the annual meeting, Berkshire began purchasing Occidental shares again. Over the next ten days, Berkshire paid $388 million to purchase an additional 6,789,392 shares of Occidental at an average price of $57.14 bringing its total investment to over $7.3 billion.

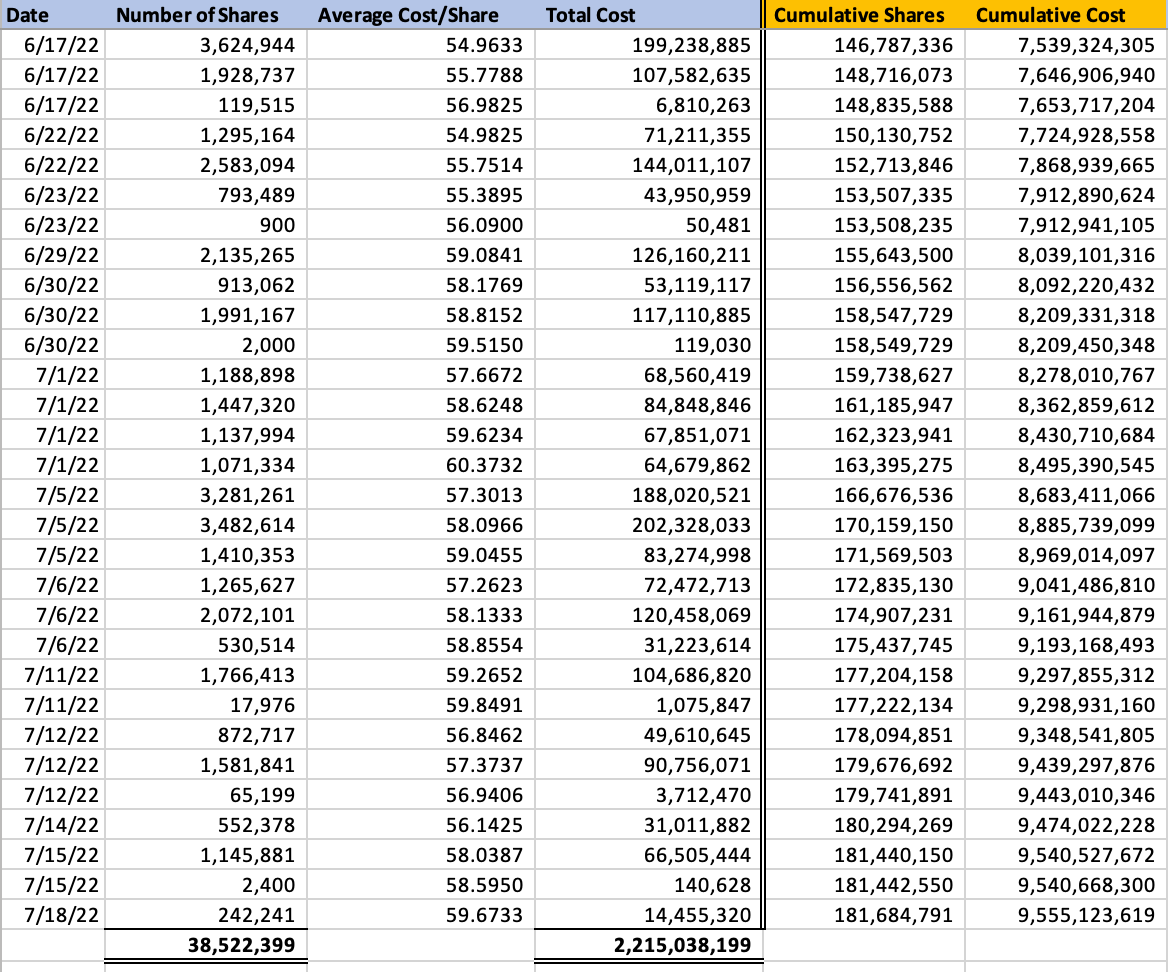

For over a month, Berkshire’s purchases stopped, but resumed in earnest on June 17 and continued through July 18. During this period, Berkshire purchased an additional 38,522,399 shares for $2.2 billion, or an average cost of $57.50 per share.

All told, Berkshire has purchased 181,684,791 shares of Occidental for $9.56 billion, at an average cost of $52.59. As of mid-afternoon on July 21, Occidental shares are trading at $61.30 per share giving Berkshire’s 19.4% position in Occidental common stock a market value of $11.1 billion and indicating a capital gain of ~$1.6 billion.

Berkshire holds additional investments in Occidental beyond its recent common stock purchases. In 2019, Berkshire invested $10 billion in Occidental cumulative preferred stock, which pays a 8% dividend, and received warrants to purchase 83.86 million shares of Occidental common stock at $59.62 per share.

From a spectator’s perspective, Berkshire’s investment in Occidental allows for monitoring with a short lag since a Form 4 must be filed within a few days of transactions. It is difficult to know what Mr. Buffett’s strategy is for accumulating shares, although I have read some speculation that the $60/share could be his limit. However, the more interesting question is whether Berkshire will continue buying and surpass the 20% ownership threshold. At that level, there are some accounting and tax implications that are worth considering.

Equity Method Accounting

From an economic standpoint, owning 19.9% of Occidental Petroleum versus owning 20.0% is only a minor difference. However, breaching the 20% threshold has some accounting implications regarding how Berkshire carries the investment on its financial statements. It is doubtful that Warren Buffett would be motivated to exceed 20% ownership due to these accounting rules, but they nonetheless exist and affect how market participants might view the situation.

In most cases, Berkshire carries equity investments at fair market value and only dividends received from the investee are counted as income. However, when an equity position breaches 20%, the equity method of accounting makes it possible for Berkshire to include the proportional net income or loss of an investee in its own results. In addition, under the equity method, the investment is no longer carried at fair market value. Instead, it is carried at historical cost with adjustments made for the proportional share of net income or loss. Any dividends received are deducted from the carrying value of the investment.

The equity method of accounting is used when a company has a “significant influence” over an investee. What is significant influence? According to the PricewaterhouseCoopers US IFRS & US GAAP guide, significant influence is presumed to exist for investments of 20% of more in common stock. For example, Berkshire currently uses the equity method for its 26.6% investment in KraftHeinz due to its presumed influence over management.

According to a recent Wall Street Journal article, analysts expect Occidental to earn about $10 billion in 2022. With an investment of under 20% of the common stock, Berkshire would only report dividends received from Occidental as income. At the current quarterly dividend of $0.13 per share on the common stock, Berkshire would report approximately $94.5 million of dividend income if the investment remains under 20%. However, exceeding 20% would result in Berkshire reporting 20% of Occidental’s expected $10 billion of earnings, or $2 billion.

This accounting treatment does not change economic reality for Berkshire since the cash received from Occidental on the common stock is still $94.5 million, not $2 billion. Berkshire would pay taxes on the dividend it receives, not on its proportional share of Occidental’s net income, regardless of whether equity method accounting is used. However, investors may view the boost to Berkshire’s net income as meaningful.

Dividends Received Deduction

While including Occidental’s proportionate net income in Berkshire’s results has no underlying economic meaning, the tax treatment of actual cash dividends received by Berkshire does change when ownership exceeds 20%.

To reduce the impact of multiple layers of taxation, corporations are permitted to take a tax deduction for part of the dividend income received from equity investments in other companies. The deduction is generally 50% of the dividend received, but this increases to a 65% deduction when ownership in the investee exceeds 20%.

As noted above, Berkshire would receive $94.5 million of common stock dividends annually if the current quarterly dividend of $0.13 per share is maintained. In addition, Berkshire receives $800 million of dividends annually from its investment in Occidental preferred stock.

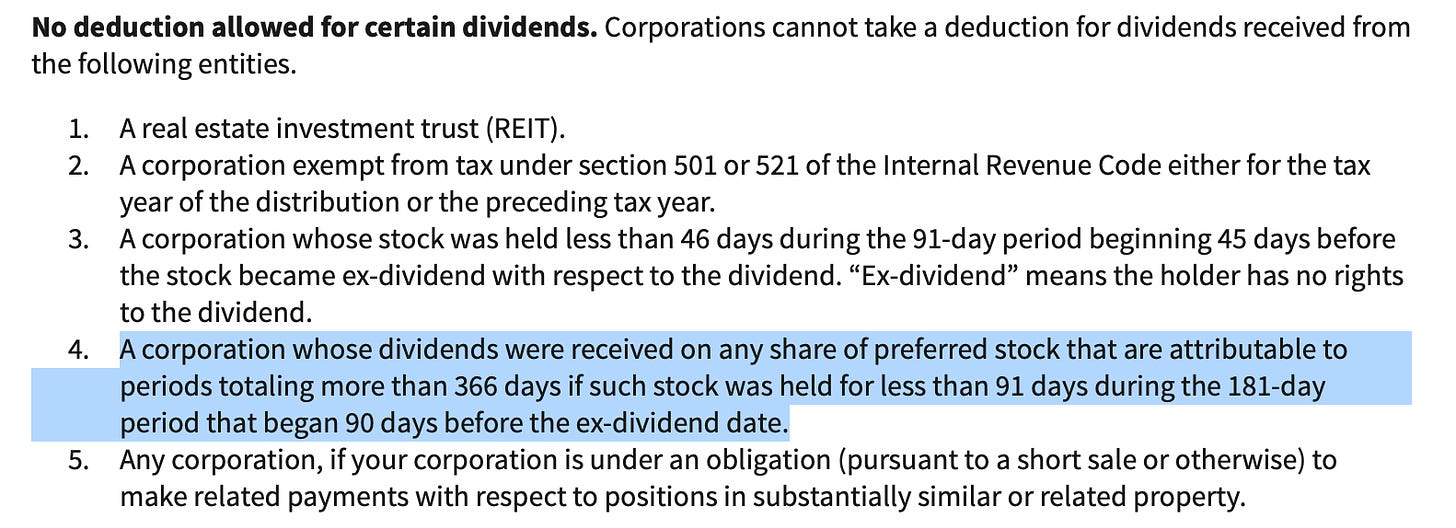

With the caveat that I am not a tax expert, it appears likely that both the common and preferred dividends qualify for the dividends received deduction. The IRS has published the following guidance for situations where preferred stock dividends would not qualify for the dividends received deduction:

Since Berkshire has held its preferred stock of Occidental on a continuous basis since it was acquired in August 2019, it would appear that this exclusionary condition does not apply and that the dividend received deduction on the Occidental preferred would qualify for the deduction. At least, that is my understanding of the information on the IRS website as someone who is definitely not an expert on the corporate tax code.

If this assessment is correct, Berkshire would benefit from being permitted to deduct 65% of the $894.5 million of dividends received from Occidental rather than 50% once ownership in Occidental exceeds 20%. This would imply an additional deduction of 15% of $894.5 million, or $134.2 million. Assuming the statutory federal income tax rate of 21%, this enhanced deduction could be worth ~$28 million to Berkshire.

Would Warren Buffett be motivated to exceed 20% ownership of Occidental to benefit from this relatively small tax break relative to the size of the investment? I doubt this would be a strong motivation, but more of a pleasant side-effect if he wants to increase the Occidental position for other reasons.

Will Buffett Acquire Occidental?

Does Warren Buffett plan to eventually acquire Occidental? Berkshire has taken large stakes in companies in the past that led up to an acquisition. The case of BNSF is a good example of Berkshire building up a large position prior to making an offer for the entire company. Berkshire began buying BNSF shares in 2006 and exceeded 20% ownership in the fourth quarter of 2008, at which point it adopted the equity method of accounting, and in February 2010, Berkshire completed the acquisition of BNSF.

Of course, anything is possible, but I am quite skeptical that an acquisition will occur for a few reasons:

Politics/ESG. Berkshire has been under pressure from climate activists to provide more disclosure regarding carbon emissions and to take stronger actions to curb the company’s carbon footprint. Owning Occidental Petroleum as a subsidiary will only increase these pressures and the associated political risks. Even if Occidental continues their current ESG policies under Berkshire’s ownership, it would create unwanted attention at the parent company level. I can already see politicians in front of microphones demanding that “Warren Buffett should stop profiteering and cut the price of gas at the pump.”

Preferred Stock and Warrants. Berkshire currently owns $10 billion of Occidental preferred stock with a 8% annual dividend as well as options to purchase 83.86 million shares of Occidental common stock at $59.62 per share. Occidental has the option to redeem the preferred stock at a 5% premium starting in 2029. The warrants expire one year after the redemption of the preferred stock. Would Berkshire want to give up the economics of the preferred and the warrants over the next seven years?

Reduced Flexibility. Mr. Buffett highlighted how he was able to purchase 14% of Occidental over a two-week period. The market dynamics that permitted accumulation of that many shares so quickly would likely exist if he chooses to sell the shares in the future. In other words, the market for Occidental seems very liquid. Berkshire only acquires companies that are intended to be held “forever”, or at least for an indefinite period. Does Occidental qualify as a “forever” investment, or would Mr. Buffett choose to reduce Berkshire’s exposure to petroleum if geopolitical conditions change again?

Although I doubt that Berkshire will acquire Occidental Petroleum, I was surprised when Berkshire acquired BNSF. Both Warren Buffett and Charlie Munger clearly believe that petroleum will not cease to be in demand for a long time to come, and perhaps they are moving toward an acquisition. Time will tell!

Disclosure: Individuals associated with The Rational Walk LLC own shares of Berkshire Hathaway common stock. No position in Occidental Petroleum.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

I think another option for Berkshire with the Occidental investment, is a carve-out. Buffett and Abel may be interested in the midstream or chemicals business of Occidental.